In the intricate world of taxes and government benefits, understanding how much tax is deducted from EI payments can feel like navigating a labyrinth.

Most of the time, Employment Insurance (EI) payments have some income tax deducted from them with each payment.

Many people think that amount will be enough to “cover” their taxable income and that they won’t owe anything more.

However, this may worry you because the normal amount that is deducted is a lower percentage than what you will often have to pay on your taxable income for the year.

Don’t worry so much about it because this post aims to shine a light on the subject, unraveling the complexities and helping you grasp just how much tax is deducted from your hard-earned EI benefits.

Let’s get to it already, shall we?

The Basics of Employment Insurance (EI)

Employment Insurance, a safety net for Canadian workers, provides temporary financial assistance to individuals who find themselves unemployed through no fault of theirs.

Or those unable to work due to various circumstances like the arrival of a baby, seasonal work changes, layoffs, ill or pregnancy, or providing care for a sick relative.

It’s essential to comprehend the financial aspects, such as tax deductions, to make informed decisions during these times of need.

Understanding Tax Deductions

When it comes to EI payments, taxation isn’t a one-size-fits-all scenario.

The amount of tax deducted depends on several factors, including your province, overall income, and previous tax contributions.

EI benefits are taxable income, but the specific deduction rate can vary.

4 Factors Influencing Tax Deductions

1. Provincial Differences

Tax rates differ across provinces in Canada.

This variance can impact the final amount of tax deducted from your EI payments.

So, try determining the tax rate in the province where you reside.

2. Total Income

Your overall income for the tax year plays a significant role in determining the tax rate applied to your EI benefits.

Those with higher total incomes might face higher tax deductions.

3. Previous Contributions

Your past tax contributions, including your contributions to EI premiums, can influence the tax deductions.

Those who have consistently contributed may experience different deduction rates than those who haven’t.

4. Calculating Tax Deductions

The Canada Revenue Agency (CRA) utilizes a progressive tax system, meaning that higher-income individuals pay a higher tax percentage on their earnings.

Your EI payments contribute to your total income, so your tax bracket and deductions are determined accordingly.

3 Ways to Estimate Tax Deductions

1. Identify Tax Bracket: Determine your tax bracket based on your total income, which includes EI payments and any other sources of income.

2. Apply Tax Rate: Apply the applicable tax rate to your EI benefits.

This rate is determined by your tax bracket and the specific province you reside in.

3. Subtract Deductions: Subtract the calculated tax deduction from your total EI payment to find your net after-tax amount.

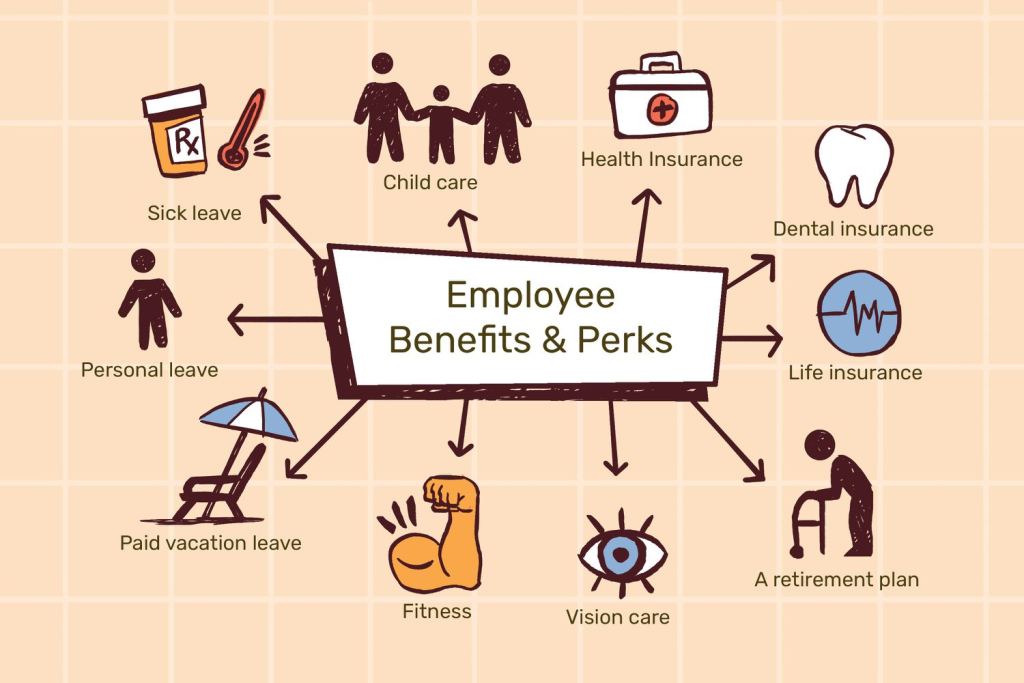

6 Benefits Of Employment Insurance

In a world where uncertainty often lurks around the corner, having a safety net can be a lifeline.

Employment Insurance (EI) isn’t just a bureaucratic acronym; it’s a transformative program that can provide individuals with a lifeline during challenging times.

Let’s dive into the often-overlooked benefits of EI and discover how it can unexpectedly empower lives.

1. Financial Stability in Unpredictable Times

The first and most apparent benefit of Employment Insurance is its role in providing financial stability when the unexpected strikes.

Whether you’re laid off, face a medical condition that prevents you from working, or are experiencing parental leave, EI ensures that you have a steady income stream to cover your basic needs and maintain a semblance of normalcy.

2. Support for Career Transitions

Employment Insurance isn’t just about bridging gaps between jobs.

It also offers a unique opportunity for career transitions.

Find yourself in a job that’s a poor fit or doesn’t align with your aspirations.

EI benefits can provide you with the time and financial support needed to explore new avenues, upgrade your skills, and pursue the career you truly desire.

3. Emphasis on Work-Life Balance

The modern world is awakening to the importance of work-life balance. Employment Insurance recognizes this need by offering benefits for parental leave and caregiving.

It empowers parents to spend quality time with their newborns or adopted children without worrying about financial strain.

Moreover, caregivers can take time off to support their loved ones during critical periods without compromising their financial security.

4. Health and Well-being Matters

Physical and mental health are cornerstones of a fulfilling life.

Employment Insurance extends its reach to individuals facing health challenges.

If a medical condition prevents you from working, EI sickness benefits can provide you with the resources to focus on your recovery and well-being rather than stressing over finances.

5. Encourages Entrepreneurial Spirit

Employment Insurance isn’t just about traditional employment scenarios.

It can also be a safety net for budding entrepreneurs.

The benefits can offer a cushion while you take the bold step of starting your own business.

This safety net can embolden innovators to take calculated risks, fostering a culture of entrepreneurship and innovation.

Also see: Super Visa Health Insurance For Canada Visitors

6. Social Cohesion and Stability

Employment Insurance contributes to the overall social stability of a nation by preventing individuals from falling into extreme financial hardship during difficult times.

By offering a sense of security and stability, EI promotes social cohesion, reducing the burden on social assistance programs and contributing to a healthier society.

Employment Insurance is much more than a safety net; it’s a testament to a society’s commitment to its citizens’ well-being and progress.

The hidden benefits of EI extend far beyond financial assistance.

They touch upon personal growth, career exploration, family bonding, health restoration, and entrepreneurial endeavors.

In a world where the unexpected is the only certainty, EI stands as a beacon of hope, ready to empower lives and foster resilience in the face of adversity.

7 Different Types of Employment Insurance Benefits

Employment Insurance (EI) benefits are like a versatile toolkit, offering a range of support mechanisms for various life scenarios.

From unexpected job loss to welcoming a new member into the family, EI benefits are designed to cater to many situations.

In this post, we’ll explore the different types of EI benefits, each weaving a unique thread in the intricate safety net that EI provides.

1. Regular Benefits

The most common type of EI benefits, Regular Benefits, come into play when you face temporary job loss due to factors beyond your control.

These could include layoffs, seasonal work gaps, or even disruptions caused by strikes.

Regular Benefits provide financial support during the transition period between jobs.

2. Maternity and Parental Benefits

Welcoming a new baby is a life-altering event.

EI’s Maternity and Parental Benefits ensure parents have time to bond with their newborns or adopted children without worrying about finances.

Maternity Benefits support mothers during pregnancy and childbirth, while Parental Benefits offer time for both parents to be with their child during the early stages of life.

3. Sickness Benefits

Health setbacks can disrupt your ability to work.

Sickness Benefits Step in when you ca unable to work due to a medical condition.

This benefit provides temporary financial assistance, allowing you to focus on recuperation and ensuring your health isn’t compromised due to financial stress.

4. Compassionate Care Benefits

Caring for a seriously ill family member is a responsibility that financial concerns should never hinder.

Compassionate Care Benefits support individuals taking time off to care for a gravely ill family member with a significant risk of death within 26 weeks.

5. Caregiving (Parents of Critically Ill Children) Benefits

Parents’ presence and care are paramount when a child faces a critical illness.

This benefit acknowledges the importance of parental involvement by providing financial assistance to parents who need to take time off work to care for a critically ill child.

6. Fishing Benefits

The fishing industry has its unique demands and challenges.

Fishing Benefits cater specifically to those working in this sector, providing income support during periods of unemployment due to a lack of fishing opportunities.

7. Work-Sharing Benefits

In times of economic downturn or other challenges, companies might implement work-sharing arrangements to avoid layoffs.

Work-Sharing Benefits provide income support to employees in a work-sharing agreement, helping them maintain their employment while working reduced hours.

Employment Insurance benefits are a testament to a society’s commitment to its citizens’ well-being during various life events.

From the ebb and flow of job opportunities to the joys and challenges of family life, EI benefits provide a safety net that adapts to your needs.

By recognizing the diverse range of situations people face, EI showcases its versatility as a support system that weaves together the threads of financial security, health, family, and societal stability.

How Much Is Employment Insurance (EI)?

Employment Insurance (EI) is a lifeline for countless individuals facing unexpected challenges in the intricate web of financial safety nets.

But how much can one expect from this crucial support system?

In this post, we embark on a journey to unravel the intricacies of Employment Insurance payments, shedding light on the factors that influence the amounts and their impact on your life.

Understanding the Variables

The amount you receive from Employment Insurance isn’t a one-size-fits-all scenario. It depends on several key variables that intertwine to determine the final figure:

1. Insurable Earnings

Your insurable earnings, which are the earnings on which you’ve paid EI premiums, play a pivotal role.

Generally, these are your gross earnings before deductions, such as taxes and pension plan contributions.

Also see: Understanding Social Insurance Number (SIN) Canada – How to Apply

2. Benefit Rate

The benefit rate is the percentage of your insurable earnings that EI will replace.

Depending on the specific program and your situation, this can vary between 55% and 80%.

3. Maximum Insurable Earnings

There’s a cap on the maximum insurable earnings that can be considered for EI calculations.

This cap is updated annually and reflects the national average weekly earnings.

4. Waiting Period

EI benefits come with a one-week waiting period where you won’t receive any payments.

This is akin to a deductible.

5. Special Circumstances

Certain situations, such as parental or caregiving leave, might have different rules and calculations for benefit amounts.

Calculating Employment Insurance Payments

1. Determine Insurable Earnings

Calculate your insurable earnings over the relevant period.

These are the earnings on which you’ve paid EI premiums.

2. Calculate the Benefit Amount

Apply the benefit rate to your insurable earnings.

For instance, if the rate is 55% and your insurable earnings are $1,000, your benefit would be $550.

However, as of January 1, 2023, the maximum yearly insurable earnings amount is $61,500.

This means you can receive a maximum amount of $650 per week.

3. Check Maximum Benefit

Ensure that your calculated benefit doesn’t exceed the maximum insurable earnings cap for the current year.

4. Factor in Waiting Period

Remember to subtract the one-week waiting period from your calculated benefit.

The Impact of Employment Insurance

Employment Insurance payments aren’t just numbers on paper; they can profoundly impact your financial stability during challenging times.

Whether you’re navigating unexpected job loss, health issues, or family responsibilities, EI offers a safety net that can prevent financial distress and allow you to focus on what truly matters.

Employment Insurance isn’t just about numbers; it’s about safeguarding your financial well-being when life takes an unexpected turn.

By understanding the variables that influence your EI payments, you can better prepare for challenging situations and make informed financial decisions.

In a world where uncertainties abound, Employment Insurance provides a much-needed anchor, ensuring you’re not alone on your journey through the ever-changing tides of life.

How Long Does My Employment Insurance (EI) Last?

When facing the uncertainties of unemployment or unforeseen life circumstances, understanding how long Employment Insurance (EI) benefits last is essential.

Let’s explore the various factors that influence the duration of EI benefits, shall we?

1. Benefit Period Duration

The duration of your EI benefits is structured within what’s known as the “benefit period.”

A benefit period lasts 52 weeks (one year) from the date you become eligible for EI benefits.

This 52-week timeframe is crucial to remember as you navigate your benefits.

2. Number of Weeks of Benefits

Within your benefit period, you’ll receive a specific number of weeks of benefits.

The number of weeks you’re entitled to depend on factors like your employment history, regional unemployment rate, and the type of EI benefits you claim.

3. Regular Benefits

If you’re claiming Regular Benefits due to temporary job loss, your accumulated insurable work hours determine the number of weeks you’ll receive.

The more hours you’ve accumulated, the longer you can receive benefits, from 14 weeks to a maximum of 45 weeks.

4. Special Benefits

Special benefits, like Maternity, Parental, Sickness, Compassionate Care, and Parents of Critically Ill Children Benefits, have different timeframes.

For instance, Maternity Benefits can be claimed for up to 15 weeks, while Sickness Benefits can be claimed for up to 15 weeks.

5. Extensions and Renewals

Sometimes, extensions or renewals may be available if certain conditions are met.

For example, if you’re still unemployed when your initial EI benefits run out, you might be eligible for an extension under certain circumstances.

6. Reporting Requirements

It’s crucial to keep track of your reporting requirements.

You must submit bi-weekly reports to maintain your eligibility and receive your benefits.

Failure to report as required could lead to interruptions or even cessation of benefits.

7. Regional Variations

It’s important to note that certain regions might have additional benefits or programs available.

For example, regions with higher unemployment rates might offer extended benefits.

The duration of Employment Insurance benefits is influenced by various factors, including your employment history, the type of benefits you claim, regional conditions, and more.

Understanding the timeframe within which you can receive benefits is essential for effective financial planning during periods of uncertainty.

As you navigate the intricacies of your benefit period, stay informed, keep up with reporting requirements, and remember that EI is designed to provide essential support when needed.

Do I Have to Pay Back My Employment Insurance (EI) Benefits?

Receiving Employment Insurance (EI) benefits can be a lifeline during financial uncertainty.

However, understanding the potential for repayment is crucial to managing your finances effectively.

Check out the circumstances under which EI benefits might need to be repaid:

1. Overpayment Scenarios

While EI benefits are designed to provide financial assistance when you need it, there are instances where an overpayment might occur.

This could happen if you inadvertently provide incorrect information, fail to report changes in your situation or have errors in processing your benefits.

2. Misrepresentation and Fraud

Intentionally misrepresenting your situation or committing fraud to receive EI benefits can lead to overpayments.

It’s important to be honest and provide accurate information to ensure you receive the benefits you’re entitled to without any complications.

3. Repayment Obligations

If you receive more EI benefits than you’re entitled to, you may be required to repay the excess amount.

This could involve repaying a portion or the entirety of the overpaid benefits.

4. Repayment Plans

The Canada Revenue Agency (CRA) handles the repayment of EI benefits.

If you’re required to repay an overpayment, the CRA will communicate the details and options for repayment.

They might offer flexible repayment plans to ensure the process is manageable for you.

5. Appeals and Disputes

If you believe you’re not responsible for the overpayment or disagree with the repayment amount, you have the right to appeal the decision.

Communicating with the CRA and providing any necessary documentation to support your case is important.

6. Prevention and Prudent Reporting

The best way to avoid overpayments and potential repayment is to provide accurate and up-to-date information.

Make sure to report any circumstances promptly changes to the relevant authorities to ensure your benefits are correctly calculated.

While Employment Insurance benefits are designed to provide crucial support during times of need, it’s important to be aware of the potential for overpayments and the need for repayment under specific circumstances.

Staying informed, being honest in your reporting, and promptly addressing any discrepancies can help you navigate the EI system effectively and avoid potential repayment obligations.

Remember that clear communication and prudent financial management are key to ensuring you receive the benefits you need without any complications.

Also see: How Do I Find My National Occupation Classification (NOC) Code?

Know How Much Deduction is Made From Your EI Payments

Unraveling the mystery of tax deductions from Employment Insurance payments requires careful consideration of multiple factors.

It’s crucial to remember that while EI benefits are taxable income, the amount of tax deducted is influenced by your total income, provincial tax rates, and past contributions.

By familiarizing yourself with these variables, you can make informed decisions about your finances during periods of unemployment or inability to work.

Remember, seeking professional advice from accountants or tax experts can provide personalized guidance tailored to your situation.

For more information, click the like button, subscribe to our newsletter, or leave a question in the comment box below.