International students in Canada can now open student bank accounts as an entry-level to the Canadian banking system. In this article we covered a step by step guide to open a student bank account in Canada.

We would cover:

- Are student bank accounts worth it for international students in Canada?

- What are the basic requirements to open a student bank account in Canada?

- Which Canadian bank is the best for international students?

- And lots more.

So, if you’re looking for the best student bank account in Canada to open, this guide is for you.

Let’s dive right in!

Are Student Bank Accounts Worth it for International Students in Canada?

First things first, when immigrating to study in Canada for any course of your choice and degree, you’re already entitled to a student bank account.

A student bank account in Canada is a current account designed to be used by anyone enrolled to study in Canada.

Opening a student bank account is definitely worth it as they offer exclusive perks that are quite different from other regular types of current accounts. Some of these include access to overdrafts for students, which are usually accompanied by very low-interest fees.

PS: An overdraft in student accounts allow scholars to have access to funds from the bank they’re registered with, via their current account, once it’s at its minimum of zero.

This goes a long way to assisting you financially while studying in Canada.

Banks in Canada usually use all these measures to attract more students as customers because once they are able to win you as a trusted customer, it’d be hard for you to let them go, even after you’ve graduated from your program.

What are the Basic Requirements to Open a Student Bank Account in Canada?

You must be at least 17 years of age to qualify for a student bank account in Canada. Then, you’ll be required to show proof confirming your higher education – usually in the form of a simple letter from your institution of study that confirms your place in the institution.

You’ll also be required to provide the following documents:

- Passport

- Birth certificate

- Proof of address

- And some times, your driving license

Application for a student bank account in Canada can be done easily online, or designated branch, all depending on the requirements of the bank

And usually, when you graduate and are done with schooling, your bank will convert your student bank account into a graduate account. This phase is usually accompanied by even a much lower interest fee on overdrafts.

This is simply to allow you to easily pay off your debt.

Which Canadian bank is the Best for International Students?

The top 9 best Canadian banks best for international students include:

- CIBC

- Scotiabank

- RBC

- BMO

- ICICI

- SBI

- Bank of China

- ICBC

- HSBC

The below infographics shows the above-stated banks, and what they actually offer for international students.

#1: CIBC

As a student living in Canada on a limited income, it’s very easy to get pissed when charged with those little but “huge” service and transaction fees that most banks usually charge.

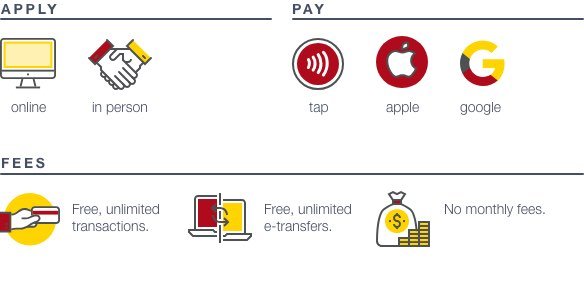

CIBC’s student bank accounts basically cost nothing… With no monthly charges and unlimited access to free transactions and online transfers!

Another very notable benefit of opening a CIBC student account is its no-annual-fee credit card. With this, you don’t need a security deposit to qualify for an international student’s credit card.

With the CIBC’s International Student Pay Program, you’ll be able to pay your school fees while studying in Canada with your preferred currency and from any location in the world.

The below illustration shows how CIBC operates at a single glance:

CIBC also rewards international student customers with travel or cash backs that can be used for home trips at the end of each semester and can as well be used for your daily grocery shopping and purchase of school materials.

You and a friend can also earn up to $25 each via the CIBC’s referral program

#2: Scotiabank

This is the 3rd largest bank in Canada with a total of about 24 million customers and more than 2,700 branches worldwide.

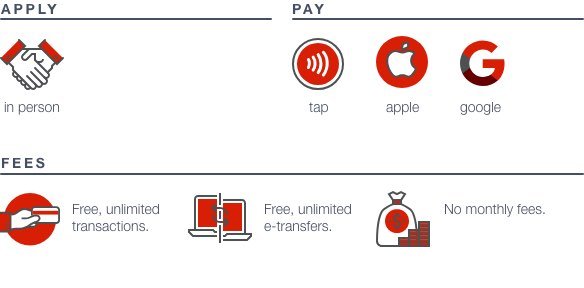

Scotiabank offers international students a StartRight Program to assist them in earning a living easily while banking in Canada. This program offers international students a chequing account fee, with no monthly charges and unlimited transactions and online transfers.

The following illustration shows how Scotiabank operates at a single glance:

Now for the movie lovers, Scotiabank partnered with Cineplex’s SCENE® program to provide free movie rewards for new members.

#3: RBC

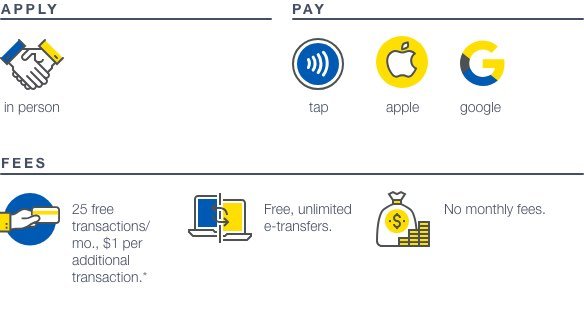

The Royal Bank of Canada (RBC) offers the best student bank account in Canada. They are well known for their extensive ATM network that spreads across the country.

They also offer zero transaction fees for a student bank account in Canada, but this only extends to only your first year of study after which you’d start getting charged for each transaction.

Some other exclusive features of the RBC are its no-annual fee for student accounts, and you won’t have to have your credit history checked to qualify for a credit card.

Students can enjoy free shopping or huge discounts in stores like Starbucks and Amazon via the RBC’s Rewards program.

What’s more???

You are now able to transfer money online via Siri or iMessage!

The following illustration shows how the Royal Bank of Canada operates at a single glance:

One of the futile blows of the RBC is its limited monthly transaction fees that are usually capped at 25 a month, costing about $1.00 each.

#4: BMO

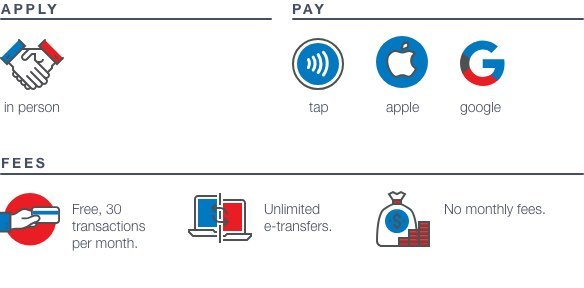

One of the troubling parts of being a student abroad is having to send money back home quickly and safely. but with BMO, all this is made pretty much easy.

Available on the BMO mobile app and online banking, and via the BMO’s partnership with the Western Union, students can now transfer funds very easy to over 200 countries around the world.

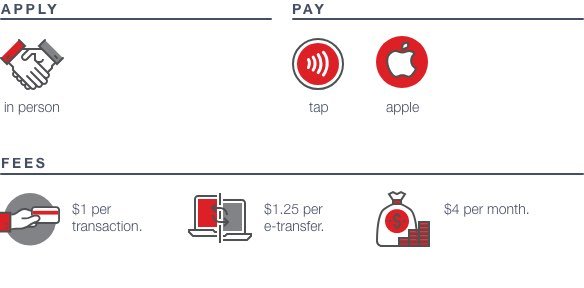

The following illustration shows how BMO operates at a single glance:

For a student bank account in Canada, BMO also offers free banking, and this extends until their graduation. You can also a free SPC card that gives you access to discounts from retailers across the country.

#5: ICICI

This is a student bank account in Canada for Indian students.

An ICIC student bank account in Canada is a Non-Resident External (NRE) savings account that gives you the ability to manage your finances very easily and with convenience while studying in Canada.

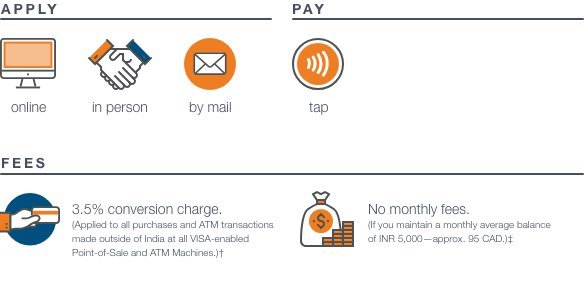

The following illustration shows how ICICI operates at a single glance:

Similar to other student bank account in Canada, ICICI for students is basically free, but though, you’ll be required to pay a monthly average fee of INR 5,000 ($95 CAD) to prevent any additional fees.

#6: SBI

This is also another very good student bank account in Canada for Indian nationals.

The SBI’s Global Ed-Vantage program offers loans of up to $37,000 CAD (Rs. 20 lakhs) to Indian nationals, which can be applied for online, with a pretty fair amount of interest rate.

This loan extends to 15 years, which gives you enough time to pay it back.

#7: Bank of China

With the Bank of China, you can set up your student bank account in Canada even before you arrive.

Similar to other student bank account in Canada, the Bank of China offers eligible students a GIC service that speeds up their VISA application process.

The bank also offers newcomers the ability to purchase their own homes in Canada via the personal residential mortgage program with supporting documents from China.

The following illustration shows how the Bank of China operates at a single glance:

But note, the Bank of China student bank account is only free for students that maintain a closing balance of $5,000 and above.

#8: ICBC

ICBC stands out as one of the best accounts for students in Canada as they offer seamless services for customers, no matter where you are in the world.

Just like the Bank of China, you also get the option of opening a student bank account in Canada prior to your arrival.

The following illustration shows how the ICBC operates at a single glance:

The ICBC also offers a GIC option similar to that of the Bank of China that enables students in Canada to keep up with their daily funding requirements.

#9: HSBC

This bank offers students a joining bonus of up to $100 for FREE for just opening a student bank account in Canada with them.

Though, all these benefits come with a minimum initial deposit of $10,000 for the first month of opening the account.

And similar to the Bank of China and the ICBC, you can open your student bank account in Canada prior to your arrival to the country.

The following illustration shows how the HSBC operates at a single glance:

HSBC also lets international students do global transfers to their own local bank accounts easily from Canada.

Now I’d Love to Hear from You:

- Which of the above student bank account in Canada would you love to open?

- Why would you want to bank with them as a student?

Let me know by leaving a comment below!